If you’re wondering “What’s the smartest way to invest in crypto in 2025?”, you’re not alone. The crypto market is rapidly evolving, with new opportunities and risks emerging every day. From Bitcoin halving to the rise of AI-driven trading and regulations shaping investor safety, this year is one of the most critical in crypto’s history.

In this step-by-step guide, we’ll break down the top 10 crypto investment tips in 2025 that every beginner and advanced investor must know. These proven strategies will help you minimize risks, maximize profits, and stay ahead in the volatile world of cryptocurrency.

Whether you’re just starting out or looking to refine your portfolio, this guide will give you practical tips, tools, and expert insights that will prepare you for long-term success.

Step 1: Understand the Market Before You Invest

Crypto isn’t just about buying Bitcoin or chasing meme coins, it’s an entire financial ecosystem. In 2025, new trends such as tokenized assets, decentralized finance (DeFi), and blockchain AI integrations are taking center stage.

Before investing, take time to:

- Study market cycles (bull runs and bear markets).

- Understand key terms: HODL, staking, liquidity pools, and market cap.

- Follow trusted sources like CoinTelegraph for market news.

Pro Tip: Never invest blindly because of hype. A solid foundation in market knowledge helps you avoid emotional mistakes.

Step 2: Diversify Your Portfolio

One of the biggest mistakes new investors make in 2025 is putting all their money into a single coin ~ usually Bitcoin, Ethereum, or the latest hyped altcoin. While that might feel safe (or exciting), it’s actually a high-risk move. Diversification is the golden rule of crypto investing.

Why Diversification Matters in 2025

The crypto market is highly volatile. A single news event, regulation, or hack can wipe out the value of one coin overnight. By spreading your investments across different assets, you protect yourself against catastrophic losses.

In 2025, the market is more complex than ever, with opportunities across:

- Layer-1 blockchains (Ethereum, Solana, Avalanche)

- Layer-2 scaling solutions (Polygon, Arbitrum, Optimism)

- Stablecoins (USDT, USDC, DAI)

- DeFi protocols (Aave, Curve, Uniswap)

- AI and Web3 projects (Fetch.ai, Render, Ocean Protocol)

- Gaming/metaverse tokens (Axie Infinity, Sandbox, Decentraland)

A balanced portfolio means you’re not overly exposed to the success or failure of a single sector.

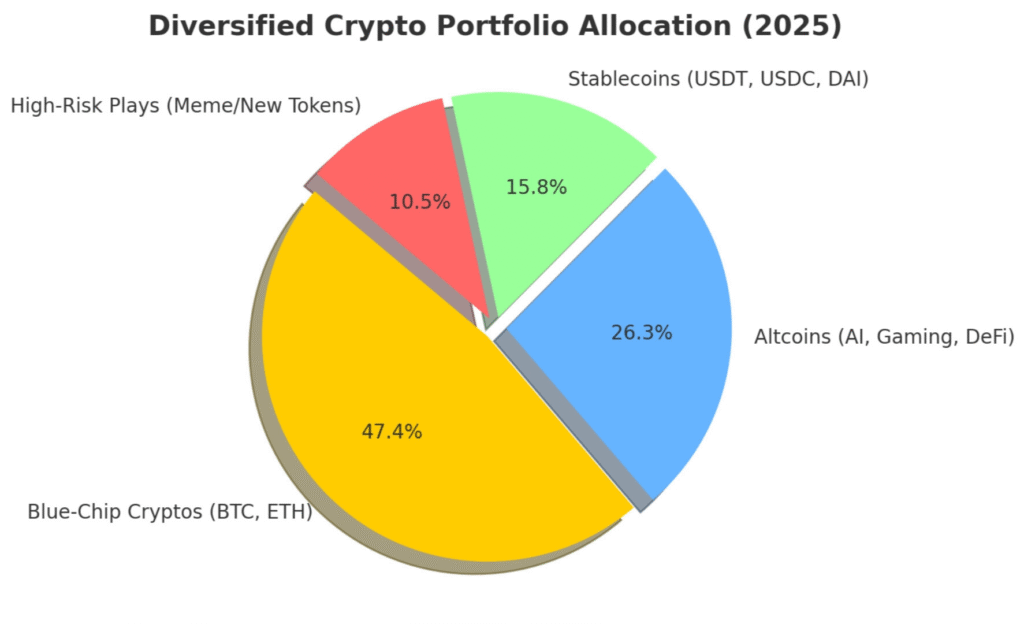

How to Build a Diversified Crypto Portfolio

Here’s a simple breakdown you can follow:

- 40–50% in Blue-Chip Cryptos: These are established, relatively stable assets like Bitcoin (BTC) and Ethereum (ETH). They form the foundation of your portfolio.

- 20–30% in Altcoins: Focus on promising projects with strong fundamentals ~ AI tokens, gaming/metaverse, or DeFi.

- 10–15% in Stablecoins: Keeping part of your portfolio in USDT, USDC, or DAI helps manage volatility and gives you liquidity to buy dips.

- 5–10% in High-Risk Plays: This is your “moonshot” allocation ~ new tokens or meme coins that could deliver massive returns but also carry the highest risk.

The Role of Stablecoins in Diversification

Stablecoins are more than just “digital dollars.” They allow you to:

- Secure profits without cashing out to fiat.

- Hedge against sudden market crashes.

- Earn passive income through lending or staking.

In a volatile 2025, stablecoins act like your emergency parachute.

Pro Tips for Smart Diversification

- Don’t over-diversify: Holding 50 coins spreads you too thin. Aim for 10–15 carefully chosen assets.

- Rebalance regularly: If one coin grows disproportionately, adjust your allocations to maintain balance.

- Follow sectors: Diversify not just across coins, but across crypto sectors, like DeFi, gaming, AI, and infrastructure.

In short, diversification isn’t about playing it safe ~ it’s about playing it smart. By spreading your investments strategically, you’re building a resilient portfolio that can thrive in the fast-changing world of crypto in 2025.

👉 READ ALSO: How I Earned $2,500/Month with Whop Clipping & Content Rewards

Step 3: Use Dollar-Cost Averaging (DCA)

Timing the market is nearly impossible, even for experts. That’s why DCA is one of the safest crypto investment strategies in 2025.

How it works:

- Invest a fixed amount (e.g., $100) weekly or monthly.

- Buy regardless of price fluctuations.

- Over time, you average out your buying price.

Example: Instead of investing $1,200 in Ethereum at once, spread it out over 12 months. This reduces the risk of buying at the wrong time.

Step 4: Focus on Long-Term Holding (HODLing)

Short-term trading can be profitable, but it’s also risky. Historically, long-term holders have gained the most wealth in crypto.

Why long-term holding works in 2025:

- Bitcoin halving in 2024 is fueling long-term bullish momentum.

- Institutional adoption is increasing stability.

- Crypto is maturing as a recognized asset class.

Action Plan: Build a core portfolio of BTC and ETH and plan to hold for 3–5 years.

👉 READ ALSO: 5 Best Side Hustles You Can Start in 2025 (Step-by-Step Guide)

Step 5: Stay Safe with Proper Security Practices

Security is everything in crypto. With rising hacks, rug pulls, and phishing scams in 2025, protecting your assets is non-negotiable.

Security checklist:

- Use a hardware wallet (Ledger or Trezor).

- Enable 2FA authentication on exchanges.

- Avoid suspicious links and always double-check wallet addresses.

For extra protection, follow best practices from Binance Academy.

Step 6: Research Before Investing in Altcoins

Altcoins (alternative cryptocurrencies beyond Bitcoin and Ethereum) are where some of the biggest profits in crypto history have been made, but they’re also where most investors lose money. In 2025, the altcoin market is more crowded than ever, with thousands of tokens competing for attention. That’s why doing proper research before investing in altcoins is one of the most critical steps in the top 10 crypto investment tips in 2025.

Why Altcoin Research Matters

- High risk, high reward: While coins like Solana, Cardano, or Polygon grew massively in past cycles, many others crashed to zero.

- Scams are everywhere: Rug pulls and pump-and-dump schemes are still common.

- Market shifts quickly: What’s trending today (AI tokens, gaming, DeFi) may not hold value tomorrow.

Investing without research is like gambling. Careful due diligence separates winners from losers.

Key Factors to Research Before Buying an Altcoin

- Whitepaper & Use Case

- A serious project always has a clear whitepaper explaining its purpose.

- Ask: Does this coin solve a real-world problem? or Is it just hype?

- Team & Partnerships

- Check if the team is transparent and has experience in blockchain.

- Partnerships with major companies or other crypto projects are strong credibility signals.

- Community Support

- Strong communities on Twitter, Telegram, and Reddit indicate genuine interest.

- Avoid projects where engagement looks fake or bot-driven.

- Tokenomics

- Look at supply, distribution, and burn mechanisms.

- Example: A coin with unlimited supply may struggle to gain value long-term.

- Liquidity & Exchange Listings

- Ensure the coin has enough liquidity and is listed on reputable exchanges (Binance, Coinbase, Kraken).

- If it’s only on shady, low-volume exchanges, that’s a red flag.

- Roadmap & Development Progress

- Is the project delivering on its promises?

- Check GitHub or official announcements for updates.

Pro Tips for Altcoin Investors in 2025

- Start Small: Don’t throw your entire budget into one altcoin. Test with small amounts first.

- Follow the Smart Money: Track wallets of institutional investors or major funds that back altcoin projects.

- Beware of Overhype: If an altcoin is trending only on TikTok or meme communities, approach cautiously.

- Use On-Chain Analytics: Tools like Nansen or Glassnode give insights into whale movements and activity.

Example: Evaluating an AI Altcoin in 2025

Let’s say you’re considering an AI-related token like Fetch.ai.

- Whitepaper: Explains decentralized AI agent use cases.

- Team: Backed by experienced researchers.

- Partnerships: Collaborating with real-world tech companies.

- Community: Active Telegram and Twitter discussions.

- Tokenomics: Limited supply with staking rewards.

This is far stronger than a random meme token with no real utility.

Altcoins can supercharge your portfolio, but only if you invest in solid projects backed by real utility, strong teams, and sustainable tokenomics. Without research, you’re gambling, not investing.

Step 7: Take Advantage of Staking & Passive Income

Why let your crypto sit idle when it can earn for you? Staking, yield farming, and lending are major passive income opportunities in 2025.

Options include:

- Staking Ethereum (ETH) for annual yields.

- Participating in DeFi lending protocols.

- Using exchanges like Coinbase or Kraken for beginner-friendly staking.

Warning: Always research staking platforms before committing funds.

👉 READ ALSO: Top 10 AI tools that will make you a million dollars Easily

Step 8: Keep Emotions in Check

The crypto market is fueled by FOMO (fear of missing out) and FUD (fear, uncertainty, doubt). Emotional investing often leads to poor decisions.

Practical steps to control emotions:

- Set clear entry and exit strategies.

- Avoid panic-selling during dips.

- Stick to your investment plan, even when Twitter trends cause fear.

Remember: Discipline beats excitement in crypto investing.

Step 9: Stay Updated on Regulations

In 2025, regulations are no longer a distant concern ~ they directly impact how you invest, trade, and even store your crypto. Governments around the world are tightening rules on exchanges, taxation, and stablecoins. Staying informed about these changes can help you avoid losses, penalties, or even frozen assets.

Why Regulations Matter for Crypto Investors

- Exchange Access: Some coins may be delisted from major exchanges if they fail to meet compliance rules.

- Tax Obligations: Crypto gains are taxable in most countries. Not knowing the law won’t protect you.

- Investor Protection: Stronger regulations often mean fewer scams and more institutional adoption, making the market healthier.

Practical Tips to Stay Ahead in 2025

- Follow Local Authorities: Check your country’s financial regulatory body (e.g., SEC in the U.S., CBN in Nigeria, FCA in the U.K.).

- Monitor Global News: Use trusted outlets like CoinDesk and CoinTelegraph for updates.

- Plan for Taxes: Keep a record of all trades, profits, and losses. Tools like CoinTracker or Koinly make tax filing easier.

- Stay Flexible: If a regulation negatively impacts a coin or exchange you use, be ready to shift strategies quickly.

Regulations in 2025 aren’t just about restrictions, they’re a sign that crypto is maturing as a global financial system. The investors who stay informed and compliant will be in the best position to grow wealth long-term.

👉 READ ALSO: If I Have to Start With 0 Dollars, This Is Exactly What I Will Do

Step 10: Have an Exit Strategy

Many investors focus only on buying, but forget to plan when to sell. Having an exit strategy is critical in 2025.

Options include:

- Target selling: Set price goals for each coin.

- Portfolio rebalancing: Take profits from winners and reinvest.

- Fiat conversion: Secure profits by cashing out to stablecoins or bank accounts.

Golden Rule: Never get greedy. Secure profits when your goals are reached.

FAQs on Top 10 Crypto Investment Tips in 2025

1. Is crypto a good investment in 2025?

Yes, crypto remains a good investment in 2025, but only if approached strategically. With Bitcoin halving boosting scarcity, institutional adoption increasing, and innovations like tokenized assets and AI-driven projects rising, the potential for growth is huge. However, investors should diversify, manage risks, and avoid hype-driven decisions.

2. Which cryptocurrency is best to invest in 2025?

The safest bets are Bitcoin (BTC) and Ethereum (ETH) since they dominate market share and have strong adoption. Beyond that, promising coins include AI-focused tokens, gaming/metaverse projects, and layer-2 scaling solutions. Always research before investing in altcoins, as many may not survive long-term.

3. How much money should I start investing in crypto?

You don’t need thousands of dollars to start. In 2025, even $50–$100 can get you started through exchanges that allow fractional purchases. The key is to only invest money you can afford to lose, and preferably use Dollar-Cost Averaging (DCA) to spread out risk.

4. What is the safest way to store crypto in 2025?

The safest method is a hardware wallet like Ledger or Trezor, combined with 2FA protection on exchange accounts. Avoid leaving large amounts of crypto on centralized exchanges. Cold storage is always the best option for long-term security.

5. Can I earn passive income from crypto in 2025?

Yes! Staking, lending, and yield farming allow you to earn passive income from crypto. Many investors stake ETH or stablecoins for steady returns. However, research each platform’s legitimacy to avoid scams.

6. How do taxes work on crypto investments in 2025?

Most countries now regulate crypto, meaning profits are taxable. Depending on your location, gains may be subject to capital gains tax or income tax. It’s important to track transactions and consult a tax professional for compliance.

7. Should I invest in meme coins in 2025?

Meme coins can generate quick profits, but they are high-risk and highly speculative. They shouldn’t make up the majority of your portfolio. If you choose to invest, keep allocations small and be prepared for high volatility.

8. Will regulations affect crypto investments in 2025?

Yes, regulations are shaping the crypto industry more than ever. While they may restrict some projects, they also increase legitimacy and attract institutional investors. Staying updated on government policies ensures you don’t face legal or tax surprises.

9. Is trading better than long-term holding in 2025?

Trading can be profitable for experienced investors, but most beginners lose money due to volatility and emotional decisions. Long-term HODLing remains a safer and more proven strategy, especially with major cryptos like BTC and ETH.

10. What’s the biggest mistake to avoid in crypto investing?

The biggest mistakes are investing without research, chasing hype, not securing your assets, and not having an exit strategy. Discipline, patience, and risk management are the keys to long-term success.

Final Thoughts: The Future of Crypto Investment in 2025

The top 10 crypto investment tips in 2025 outlined here give you a roadmap to succeed in one of the most exciting financial markets ever. By diversifying, staying secure, and planning long-term, you’ll be better positioned to ride the waves of volatility and capture real wealth.

Crypto isn’t just about getting rich quickly, it’s about building financial freedom over time. With the right knowledge and discipline, you can turn 2025 into your most profitable year in crypto.